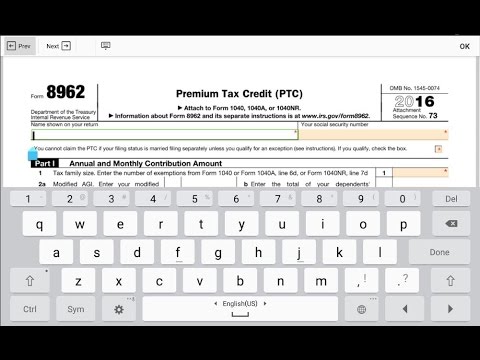

Hello guys and welcome to my channel. I'm doing a step-by-step video to help you find a different type of form. This video is a follow-up to my previous tutorial on learning how to fill out the table 18 at 52. So, to download the file form in ethic 62, you will need to read two options. Either you choose to mail it or to fax it. But, I think it's faster to fax it. On the form, you have to choose either issues to mail, so if you fax it and after that you mail it, you send a copy by mail. But, that could be a problem as it could delay the processing of your return. One more thing to remember is that on this form 1095-a, you need to write down your taxpayer identification. Most of the time, that cannot be your social security number. At the top right, write your social security number as well. And on each page, write down your social security number as the audacity to is to match both of them. Even though most of the second page is blank for the family 962, you still need to send both pages. Write down your social security number. So, most of the time, it's going to be a four-page statement. But some people may have a two-page statement 1095a. So, any scale is going to be like four pages, but most people have one page. So, one thing to remember is you need to include a cover sheet. On this cover sheet, you will need to put the following information. You can just cut this part. You got this letter. Cut this part and use it like a cover sheet. Okay, just cut this whole part and use it. On the black sheet,...

Award-winning PDF software

Where do i send my irs 843 Form: What You Should Know

Where To File — Forms Beginning With the Number 9 — IRS 30 Sep 2025 — Any tax related matter, including any tax related matters that you are requesting an abatement for Forms 1040, 1040A, 1040EZ, 1040L, 1040X, 1045, 1040NR, 1040, 1041, 1041A, 1042, 1042A, 1042AR, 1042SR, 1042XR, 1047, 1048, 1082, 1002, 1055, 1059, 1062, 1061M, 1068, 1071, 1072, 1110, 1143, 1144, 1145A, 1145B, 1145C, 1146, 1148, 1149, 1153, 1157, 1160M, 1320, 1321, 1325, 1326, 1327X, 1342, 1345, 1371, 1372M 1375, 1376, 1386, 1406, 1413, 1421, 1422, 1446, 1461, 1465, 1466, 1471, 1473X, 707, 709, 713, 713A, 713B, 763, 795, 796, 2326X, 3326X and 4335X For other forms: Form 4868, IRS Filing and Payment Assistance (APA) Where To File — Forms With the Number 11, 12, 13, 14 — IRS 26 Sep 2025 — For any tax related Where To File — Forms While the Number Is 12 — Internal Revenue Service For Form 1241 — IRS Income tax return with a balance due (IRA) Form 1040-N For other taxes, including penalties and interest 25 Sep 2025 — Forms with the Number 2 — IRS 29 Aug 2025 — For any tax related Where To File — Forms While the Number Is 13 — IRS For Form 1345 — IRS Income tax return with a balance due (IRA) Form 1040-X For other tax forms 25 Sep 2025 — Form 741: Filing Information With the IRS — IRS A joint return that has a balance owed from one spouse to the other (IRA) Form 1040-X For other taxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 843, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 843 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 843 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 843 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where do i send my irs form 843